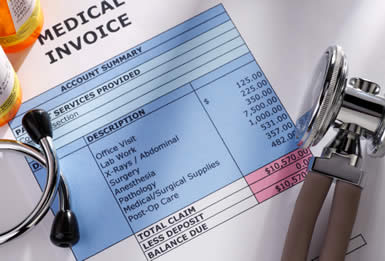

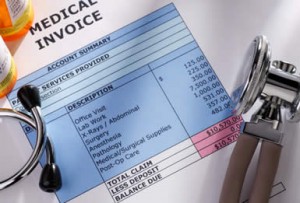

Coping with Sudden Medical Costs

Even with health insurance, an unexpected injury or illness can have a devastating effect on your life and your finances. It doesn’t help that medical treatments in the U.S. are often several times more expensive than in other countries. For example, a CT scan of the abdomen costs an average of $124 in Canada, while in the U.S. it can cost as much as $1,737. Some might argue that this is because the U.S. has some of the best healthcare in the world, but the reality is that the CT machine used in Canada is no different from the machine in the U.S.

Additionally, the U.S. has fewer physicians per person than other countries with lower costs, and the overall life expectancy for people in the U.S. is also no better. There are several reasons why health care is so expensive in the U.S., but better quality of care isn’t one. However, regardless of why, the fact remains that medical bills are a major financial burden for Americans’ so much so that they are the biggest cause of bankruptcies. If

you are faced with sudden medical bills, here are some options for dealing with them without losing your shirt.

Start with your bill.

You may not realize this but many medical costs are negotiable because a hospital would rather get something from you than nothing at all. You might not be able to negotiate it down to nothing, but you should be able to significantly reduce the charges, especially if you can propose an acceptable payment plan to cover the cost.

However, before you negotiate, you should also carefully review your bill. As many as eight out of ten medical bills contain errors that can significantly increase the costs. These errors could include multiple charges for the same service, charges for services that you didn’t receive, and charges for services that should have been covered by insurance. Sometimes, simply removing the errors can significantly reduce the cost.

Ask about assistance plans.

Some hospitals offer financial assistance for those who are unable to pay their bills. In some cases the hospital will even cover as much as 90 percent of the cost. These assistance programs are based on need and they usually require financial information to determine eligibility. Some programs also require that you be uninsured to receive assistance. Each program is specific to that hospital and you can find out more by talking to the billing department.

Look into patient assistance programs.

Several pharmaceutic companies offer patient assistance programs to provide free or discounted medications for people who cannot afford their

medicine. These programs could include everything from commonly-prescribed psychiatric drugs and blood pressure medications to oncology and chemotherapy drugs. Many of these programs are strictly for the uninsured, but some might also be available to patients who have insurance but still need help paying.

Borrow against your house.

Borrowing to pay medical bills is a tricky proposition, but it could be a life saver if you have exhausted all other options. The advantage to home equity loans is that they often have better interest rates than a personal loan. Also, you could use a home equity line of credit that you can tap into as needed, and pay back only what you have borrowed, rather than a lump sum where you would have to pay all of it back.

Legal Options

What happens if your illness or injury is someone else’s fault, like a broken back from a car accident or mesothelioma from exposure to asbestos? In those cases you should consider seeking legal representation, but you need to act quickly. Baron and Budd, a leader in mesothelioma litigation, recommends that you file a suit as soon as possible after your diagnosis because of the statute of limitations on mesothelioma cases.

Also, litigation can sometimes take a long time, so it’s important to get the ball rolling as quickly as

possible.

Filing a lawsuit for damages might not pay your medical bills right away, but once you settle or win your case, you can use the funds to pay back bills, pay off any loans, or replace the funds you spent out of your own pocket. You might also have money to handle future medical costs and other expenses, such as your mortgage and even utility bills.

Conclusion

A serious injury or illness can be debilitating, but it doesn’t have to be. There are options for significantly reducing the cost, and even removing some charges from your bill. If you ever find yourself with sudden medical costs, review this article for tips on relieving your financial burden.

Article by- Jennifer Smith